Sedona AZ (April 18, 2012) – The table below shows the Median Prices for closed sales of Residential property only, in the whole of Sedona, quarter by quarter. The Sedona market remains stable, and given the level of recent activity, I continue to believe that the market is in much better condition. We can go on to look at other aspects to see why.

| Apr/Jun 2010 |

Units Sold 117 |

Median Sale Price

$385,000 |

| Jul/Sep 2010 |

85 |

$387,000 |

| Oct/Dec 2010 |

107 |

$317,000 |

| Jan/Mar 2011 |

90 |

$354,000 |

| Apr/Jun 2011 |

116 |

$303,500 |

| Jul/Sep 2011 |

102 |

$400,000 |

| Oct/Dec 2011 |

79 |

$339,900 |

| Jan/Mar 2012 |

102 |

$333,000 |

First, we have a negative. The unemployment rate in the USA is still stubbornly high, despite the sizeable stimulus packages, and what would be the normal growth rate for an economy recovering from a deep recession. Two important factors in the economics of the housing market are interest rates, still attractively low, and the employment scene. Jobs allow people to pay their mortgages. The current labor force participation rate (share of the population that is working) is 63.8%, which is lower than three years ago, March 2009, when it stood at 65.6%.

The monthly headline unemployment rate, U-1, covers persons unemployed 15 weeks or longer. An alternative measure, U-6, covers total unemployed, plus all persons marginally attached to the labor force, plus total unemployed part time for economic reasons, plus all persons marginally attached to the labor force. http://www.bls.gov/news.release/empsit.t15.htm. Although declining, this measure, seasonally adjusted, is at 14.5%.

Now let us look at some positives. The above table shows us that the number of closed sales in the Sedona Residential market remains pretty constant. The total number of Units Sold for the most recent twelve month period matches exactly the number for the previous twelve month period.

However, the Absorption Rate is very much better. An Absorption Rate of less than 6 months is taken to be a Sellers’ Market, while anything over 10 months is taken to be a Buyers’ Market. The space in between is called a Transitional Market. The March Absorption Rate for Sedona Residential Home Sales is only 6.5 months. Still, rather than relying on one month’s figures, if I smooth this series using a six month moving average, then the Absorption Rate since the beginning of 2012 has been below 10 months, i.e. in Transition.

Going deeper into the numbers, the Absorption Rate for homes that sold below $250,000 is now 2 months; for those between $250,000 and $400,000, it is 6 months; and for those between $400,000 and $600,000, it is 8 months. The average for all homes below $600,000 is 5 ½ months, this given that, over the previous 12 month period, the average sold residential home value was $419,811.

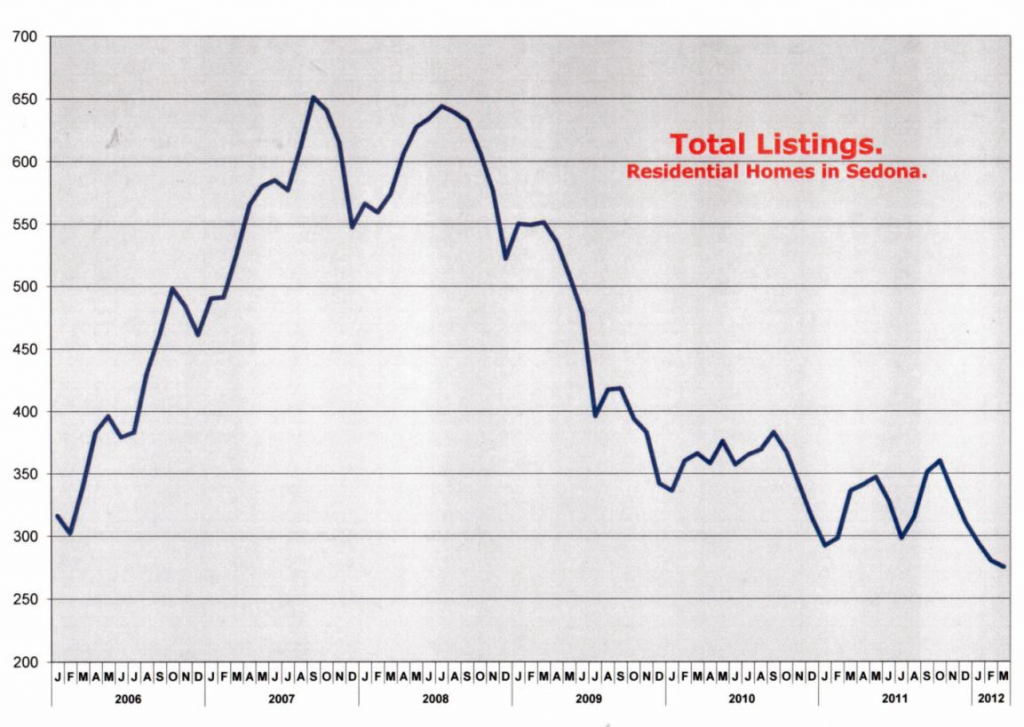

Part of the reason for this change in the market is the continuing decrease in the number of listings available for sale. Market commentators have suggested  that there are more foreclosures on the way, as the lenders return to the earlier pace prevalent before their robo-signing moratorium. The experience in the Greater Phoenix area, detailed by the Cromford Report suggests, “ …there is absolutely no evidence whatsoever of that mythical “new wave of foreclosures” promised by so many other market observers.” In Sedona, the average number of “distressed” listings (REOs and Short Sales) for the first quarter of 2011 was approximately 44. The average for the first quarter of 2012 is 26, while the Absorption Rate for these “bargain” properties has fallen to only 2 months.

that there are more foreclosures on the way, as the lenders return to the earlier pace prevalent before their robo-signing moratorium. The experience in the Greater Phoenix area, detailed by the Cromford Report suggests, “ …there is absolutely no evidence whatsoever of that mythical “new wave of foreclosures” promised by so many other market observers.” In Sedona, the average number of “distressed” listings (REOs and Short Sales) for the first quarter of 2011 was approximately 44. The average for the first quarter of 2012 is 26, while the Absorption Rate for these “bargain” properties has fallen to only 2 months.

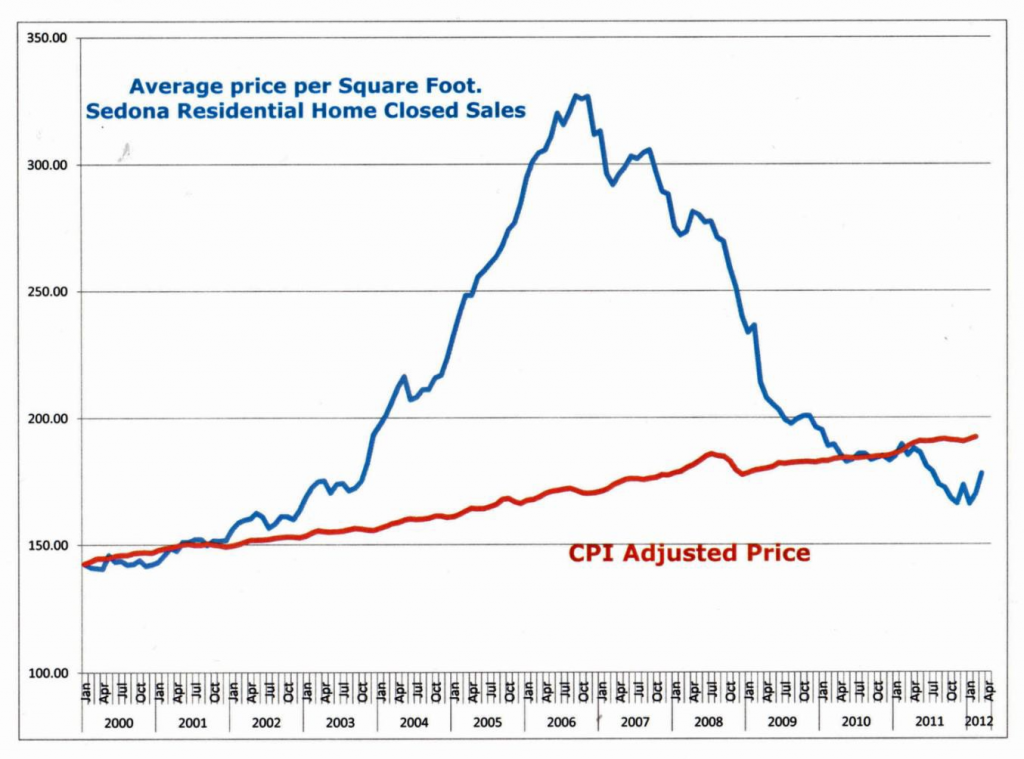

Property has always been considered to be a store of value, keeping pace with inflation, over time. I have produced a chart which uses the change in the Consumer Price Index to measure value over time. In the chart below, I have taken the 6 month rolling statistics for Sold Residential Home Sales in Sedona, and looked at the average price per square foot of those transactions.

Back in January 2000, that number was $142.38 per square foot. After adjusting for the CPI increase up to February, 2012, to keep pace with inflation, that number should now stand at $192.03. The chart shows that, after the excesses of 2006, and the collapse from 2007 through to 2011, there appears to be an attempt for the market to return to that long term value trend.

Mortgage rates continue to be attractive and yet, given that we have some improvement in the economy, market watchers are looking for the Federal Reserve to start tightening monetary policy towards the end of 2012 or early in 2013. If the US can achieve growth of 2.5% to 3% in the next two years, and the unemployment rate can fall towards the 7% level, then the Federal Reserve may see no need for further accommodation, and start to worry about inflation. Even so, there are also a number of other factors at work, both in the US economy and abroad that may have an effect on government policy.

The S&P/Case-Shiller Home Price Indices, a trailing indicator, has continued to show a drifting market over the whole of the country. Their Composite 20 Cities has declined from 142.96 to 135.36 over the last 6 months. However, in Phoenix, their index has improved from 100.43 to 102.84 over that same 6 month period. Arizona used to be one of the leading States for foreclosures. The numbers from Phoenix suggest we may be on the mend.

Having felt a glimmer of hope, back in the third quarter of 2011, and a bit more enthusiasm in the fourth quarter of 2011, I believe that the market is a lot more stable. People are still keen to acquire a piece of Sedona, and supply seems to be dwindling. The big question now is whether this mild recovery will translate into improving values.

All statistics have been obtained from the Sedona Verde Valley Association of REALTORS® Multiple Listing Service, or as attributed in the text.

Sean Baguley is an Associate Broker with Russ Lyon Sotheby’s International Realty at 1370 Hwy 89A in Sedona, Arizona. He brings a world of financial and executive skill to the table. His earlier career spanned over 30 years in the International Financial Markets, mainly in Bonds and Derivatives, based in London. He has dealt with institutional and corporate clients, structuring complex transactions.

He has well-honed negotiating skills that make any move simplified and streamlined. Sean’s background also enables him to see the bigger picture. Clients count on him to weigh their long-term real estate goals and bring their dreams into reality. He is astute about the Sedona property market, having moved here from New York City in October 2001. He helps buyers and sellers make the most of the area, whether they are investing in a retirement home, moving up, or searching for the perfect desert sanctuary.

When buying or selling a home in Sedona, it’s essential to work with an agent whose depth of skill spans finance, business, management and marketing. Sean Baguley brings all this and a unique compassion for people and their needs to each and every client.