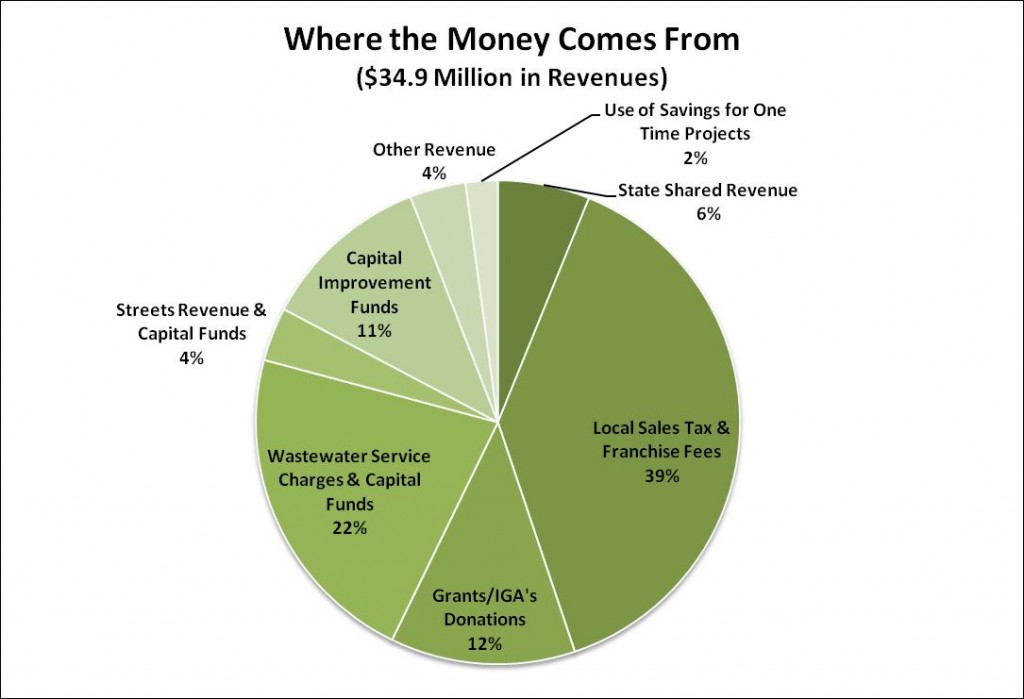

Sedona AZ (May 9 2011)–The City of Sedona issued public “Talking Points” for the 2011/12 Proposed City Budget today. The City Council is scheduled to adopt the Tentative Budget on May 24, 2011 and issued the following statement with the release of the “talking points”: Due to conservative budgeting and stronger than anticipated revenue this year, the City of Sedona is on track to realize almost a $1 Million surplus of revenue in the current fiscal year ending June 30, 2011.

- The City is planning to use part of that surplus to fund one-time projects in the next fiscal year, including increased destination marketing and support for local events.

- Council’s commitment to financial sustainability and support of significant, early cost reductions have placed Sedona in a positive cash position moving into the new fiscal year .

- While most other local government’s have used savings for operations, Sedona’s reserve funds (savings account) have actually increased through the recession – No savings will be used for operational costs in the coming FY 2011/12 fiscal year.

- The City continues to look at cost controls across all areas of operation and has provided a balanced budget between revenues and expenses.

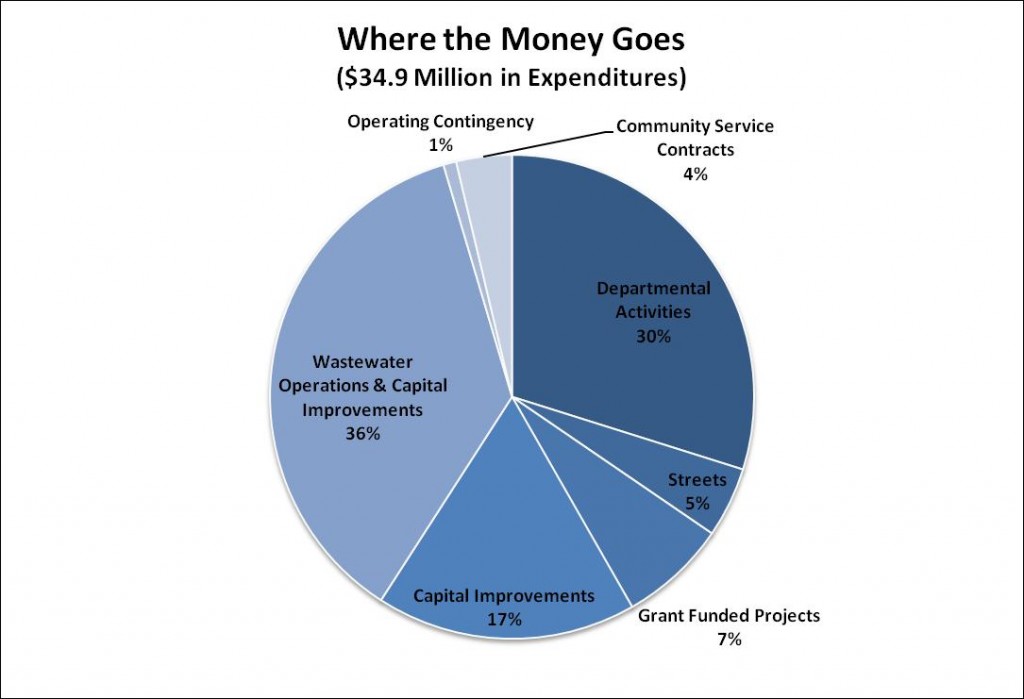

- The Council continues with its ten-year wastewater plan which will increase user fees for wastewater to a more realistic level, reduce the wastewater sales tax subsidy and allow more money to be put toward streets & other capital improvements that benefit the entire community.

- The City Council finalized a new Five Year Capital Plan that prioritizes possible major capital projects and provides a basis to plan for improvements and communicate to the public over the next five years.

- Local revenues have stabilized and are showing signs of improvement, which presents a positive future for Sedona’s residential and business community.

- The City of Sedona does not assess or collect any property tax.

- Final Budget Approval is scheduled for June 28, 2011.

Auction of Sedona Surplus Equipment: One of the Sedona City Council’s top priorities is financial sustainability. As part of the city’s goal for financial sustainability, staff continually evaluates its fleet of vehicles to ensure appropriate fleet size, vehicle use, and efficiency.

As a result, the City is auctioning two vehicles and other miscellaneous equipment through publicsurplus.com over the next 35 days with a staggered release date. If you are interested in viewing the vehicles or other items, go to http://www.publicsurplus.com and search “Agency” for City of Sedona. Check back often to see newly released items for public viewing. If you would like more information, please call the City Manager’s office at (928) 204-7127. Submitted by Ginger Wolstencroft, Sedona

After Raising Sewer Fees and Cutting Service Programs City Council Brags about 1 million dollar surpluses in city of Sedona budget! Was anyone spared the pain of a council gone wild and determined to cut every valued program in our community?

After pledging support for the Arts on the campaign trail this council wasted NO time cutting arts funding and decimating the Arts Commission. They went on to make further cuts to the Chamber, Parks, Library, Human Society, and Main Street programs to name just a few.

Were the residents of Sedona spared? No, we were slapped with raises in our sewer rates! Yes, in a time when the Food Banks, unemployment and home foreclosures are at a record high our council adds more financial burdens on the backs of the residents and business community and then to add insult to injury the city council brags about having a 1 million dollar surplus!

A 1-million dollar surplus and still the council refuse to address the flooded neighborhoods in Coffee Pot, Harmony and Sedona West. With a surplus why has the city of Sedona continued to delay road repairs and storm drains? With a surplus why did the council burden you the resident of Sedona with higher sewer rates?

Sedona, it is time to Speak Up!

Liz Smith

Save Sedona Now!

http://www.savesedonanow.com

Dear Mayor and City Councilors: I regret that an unknown computer software product went crazy and made a lot of unwanted changes in this. I’ve cleaned it up. Very sorry, but I’ve had nothing but trouble with NPG Cable’s Cheetah during the past two weeks.

From: Jean Jenks

To: Rob Adams ; Cliff Hamilton ; Marc DiNunzio; Barbara Litrell ; Mike Ward ; Dan McIlroy ; Dennis Rayner

Sent: Monday, May 23, 2011 11:31 AM

Subject: 5/24/2011 Council Agenda Item 9d, tentative city budget for FY 2011/12

Dear Mayor and City Councilors:

According to the “Things to Know about the City of Sedona’s Proposed FY 2011/12 Budget” posted on the Finance Department’s website, the City is on track to realize almost a $1 million surplus in the current fiscal year. Due to subterfuge, inadequate disclosure and wrongful information given Sedonan’s during the Wastewater rate-increase public process, I am requesting this surplus, together with the incremental revenue that will be gleaned during the 2nd year of the five-year rate-increase period, be transferred to the WW Fund and used to pay down the City’s enormous bond debt faster. Please note this payment would be in addition to the budgeted debt service payment of $5,785,447 for FY 2011/12.

As you probably know, voters were told that city sales tax revenue and Bed Taxes would be used to pay for the wastewater system back at the time it was approved. This was confirmed once again at the March 16th Budget Oversight Commission meeting by Commissioner Pack who stated the sewer system was sold to the citizens by promising that “the tourists, through hotel and sales taxes, would pay for this.” Thus we see how City Hall flat-out lied and then rescinded the agreement it made with the voters (an agreement in effect until the current fiscal year) via socializing Sedona’s sewer rate costs on the backs of innocent residents and subsidizing tourists who frequent the polluting businesses along Oak Creek.

THE WORST of the killer problems associated with CDM’s Wastewater Rate Study:

A. CDM’s TABLE 12 RATE SURVEY, wherein Bullhead City’s “Monthly Residential Bill” was listed as $63.92 for residents in Sewer Improvement District No. 1 ($31.00/mo flat & $395/yr Conveyance & Treatment) and as $104.75 for residents in Sewer Improvement District No. 3 ($31.00/mo flat & $884/yr Conveyance & Treatment), failed to disclose the predominant sewer fee scenario in Bullhead City. I specifically asked our City Manager about Bullhead City rates during the March 25, 2010 Waste Water Rate Study Open House and learned that 50% of Bullhead City is not under an ADEQ Consent Decree and pays a flat $31.00 per month residential sewer fee, no more. This, of course, is lower than Sedona’s $32.54/mo residential fee before five years of increases were approved by your predecessor City Council, effective July 2010. A corrected copy of CDM’s TABLE 12 and necessary disclosure of the flat $31.00 per month sewer fee for Bullhead City residential areas not under an ADEQ Consent Decree were never forthcoming to Sedona citizens. Very egregious that this $31.00 monthly sewer fee was omitted from CDM’s TABLE 12 RATE SURVEY, thus facilitating hefty annual sewer rate increases for five years (possibly ten) and the laundering of City Hall’s self-created WW financial mess through the wallets of ordinary residential customers with absolutely no responsibility for the pollution of Oak Creek or the City’s enormous WW system bond debt!!

B. CDM’s APPENDIX 1 EXISTING DEBT SERVICE [“based on the existing total debt service provided by the City on 6/15/2009”] lists the Series 2005 Excise Tax Bond P & I obligations for both FY 2018-19 and FY 2019-20 as $4,284,000. A review of the 2010/11 ANNUAL BUDGET “Excise Tax Revenue Bonds, Series 2005,” Page 144, reveals the $4,284,000 debt service requirement for FY 2018-19 is the last payment due and owing on this bond. The $4,284,000 entry for FY 2019-20 in CDM’s APPENDIX 1 is in error. This is a duplicate entry; the correct amount is ZERO.

C. The City’s 2010/11 ANNUAL BUDGET “Excise Tax Revenue Bonds, Second Series 2004” (Dated October 1, 2004) reveals on Page 143 that:

Of the original $18,415,000 Series 2004-2 bond obligations $13,860,000 is for WW system-related projects and $4,555,000 is for the City Hall Purchase.

$2,050,000 in principal payment obligations will be deducted with respect to the City Hall Purchase over the first eight years of the Series 2004-2 Bonds (FY 2004-05 through FY 2011-12).

ZERO, NADA, NOTHING in principal payment obligations will be deducted with respect to the WW system-related projects over the first eight years of the Series 2004-2 Bonds. Is this legal? I think not. Of note is that deferred principal payments of $2,970,000; $3,130,000; and $2,790,000 will kick in and become due and owing during the last three years of the five-year period of sewer rate increases (FY 2012-13, FY 2013-14 and FY 2014-15).

The accounting treachery associated with the Series 2004-2 Excise Tax Revenue Bonds benefits the General Fund and City Hall overspending at the expense of the WW Fund and Sedona’s overburdened sewer ratepayers. It will result in excessive P & I payments from the WW Fund of approximately (a) $1.25 million during the five years of Council approved sewer rate increases and (b) $2.1 million over the fifteen-year life of the bonds.

D. Many numerical amounts in the tables, charts and spreadsheets in CDM’s RATE STUDY, as well as most amounts for wastewater rates, rate components, fees and service charges, are excessive due to CDM’s APPENDIX 1 (EXISTING DEBT SERVICE) $2.1 million Series 2004-2 bond overcharge and the duplicate $4,284,000 debt service entry re the Series 2005 Bonds. Thus, the proceeds needed for WW Fund debt service through FY 2019-20, the last year covered in CDM’s APPENDIX 1 EXISTING DEBT SERVICE Schedules, are overstated by approximately $6.4 million P & I.

E. According to CDM’s FIGURE 1, FY 2009-10 SEWER UTILITY SOURCES AND USES OF FUNDS PER ERU (Page 3) data, 54% of the annual sewer cost per residential charge per ERU is attributable to WW system debt (I.e., approximately $6 million debt service/year). Raising residential sewer fees from $32.54 to $57.28 over five years is a 59% increase and to $75.08 over ten years is a 231% increase. Without even adjusting/correcting the $5.5 million to $6.4 million P & I debt service overcharge in CDM’s WW RATE STUDY, a sewer fee increase for the first five-year period under a zero debt scenario works out to a negative 5% (54% – 59%), while a sewer fee increase under a zero debt scenario for ten years works out to a negative 177% (54% – 231%). I believe these findings point to a massive WW system debt overload problem and the pressing need to accelerate debt reduction very significantly. I hereby recommend annual payments in the $12 to $14 million range (inclusive of debt service $$$ obligations) beginning with FY 2012/13.

F. How much are other Verde Valley municipalities charging during these bad economic times when so many area households are struggling to make ends meet? Clarkdale’s monthly sewer fee is $28.00 per residential user, Cottonwood’s is $25.00 and Camp Verde’s is $31.50. I believe the City of Sedona must do right and forego the last five years of sewer rate increases (FY 2015-16 through FY 2019-20). The City should not change the monetary transfer to the Waste Water Fund from the General Fund as a result of adopting new sewer rates, either. Effective with the FY 2011/12 ANNUAL BUDGET, all such transfer monies need to be utilized to begin systematically eliminating the City’s enormous Waste Water Fund debt of $52.5 million (per 2010/11 ANNUAL BUDGET DEBT SUMMARY, Page 138).

G. THE CITY COUNCIL NEEDS TO REJECT THE PROPOSED 10-YEAR WASTEWATER PLAN DUE TO THE OFFENSIVE OVERCHARGING OF RATEPAYERS, CDM RATE STUDY ERRORS, PUBLIC DECEPTION, INADEQUATE PUBLIC DISCLOSURE AND THE FACT THAT THE INCREASE IN WW RATES AND CHARGES WAS ADOPTED BY COUNCIL FOR FIVE YEARS, NOT TEN.

BY THE WAY, the last time I checked, the hotel fee in Yavapai County Sedona was 13.725% (3% Bed Tax, 3% City Sales Tax, 6.6% State Sales Tax, 1.125% Other). In Coconino County Sedona it was 14.475% (3% Bed Tax, 3% City Sales Tax, 6.6% State Sales Tax, 1.875% Other). Only last month my husband and I were in Omaha. The hotel fee there is currently 18.16%. Tourists are not paying their fair share here. To get Sedona in line with other major destinations, I believe the Bed Tax in Sedona needs to be increased from 3% to 6.6%. I respectfully request the City Council investigate and take appropriate action on this matter.

Sincerely,

Jean Jenks

Sedona, Arizona

P.S. I see where the City Manager recommends City employees receive a one-time compensatory award to offset increases in deductions in State Retirement plans. I vehemently oppose this!!! According to the Arizona Republic’s Pension reform a difficult task Nov. 21, 2010 front-page article: “Lawmakers in 2001 enhanced benefits for the Arizona State Retirement System, the largest public-pension plan in the state, by changing the formulas to allow workers larger pensions.” So, now that City employees [don’t know about the PD who are in a different retirement system] have been getting larger pensions since 2001, why the heck doesn’t City Hall offset their windfall increases for the past ten years? The money could be used to help pay off the PD’s growing underfunded pension liability of $654,000 — Budget Oversight Committee Chairman Fagan stated on March 16th that ‘He wants to figure out ways of reducing this.” Hey, today we taxpayers, many of whom are living on fixed incomes, face the situation that several million in State unfunded public pension liabilities are an albatross around our necks!!!!!!!! By the way, did you know that Alison Zelms pointed out the “need to change the benefits so payments go further” during the March 16th Budget Oversight Commission meeting? Super that she mentioned nothing about a one-time compensatory award estimated at $135,000 and how it would accomplish such a goal. Also, does not the City Manager, who is paid quite a hefty salary, have A CONFLICT OF INTEREST here? This whole matter is so mind-boggling and inept, I cannot believe it.

In my opinion, all because ADEQ hood-winked Lake Havasu voters into their corporate $pon$ored “big” pipe $olution … right Chuck Graf/ADEQ? …

Lake Havasu AZ City sewer project costs to rise; Valve retrofit price tag could climb to $1 million! (twice the estimate given its officials by ADEQ)

Today’s News-Herald … Published Thursday, May 26, 2011 12:13 AM MST … NATHAN BRUTTELL…City sewer project costs to rise … Officials: Valve retrofit price tag could climb to $1 million … http://www.havasunews.com/articles/2011/05/26/news/doc4dddf766a64eb841020212.txt

A Lake Havasu City sewer-valve retrofitting project could prove to be twice as costly as originally thought. City Public Works Director Mark Clark said a seven-phased project to install sewer relief valves and backwater valves at more than 4,000 homes could cost the city nearly $1 million. Officials previously indicated the project would cost closer to $500,000, but Clark said further evaluation of area homes indicated that the more costly backwater valves would be necessary at more locations.

“The original estimate that was given to the council was in the $500,000 range, but that was based on all of the valves needing to be sewer relief valves,” Clark said Wednesday. Individual costs and installation of a backwater valve can cost nearly $500, as opposed to roughly $60 for a sewer relief valve, city officials have previously said.

“Since we’ve gone through the system and identified those that need to be backwater valves,” Clark said. “That number is probably closer to $1 million now. Had we had to put in backwater valves at all of those locations, it would’ve been closer to a $5 million estimate.”

The city began installing sewer relief and backwater valves in area homes as a part of the sewer project following a few backups in early April 2010. Backwater and relief valves are both designed to ensure potential backups do not enter into homes. Backwater valves close the pathway into the home in the event of a backup, while sewer relief valves are designed to dispel the excess sewage somewhere near the home, rather than inside it.

The City Council approved the third phase of the seven-phase project Tuesday — making the actual cost of the project to date around $146,900. Clark previously said the retrofit project is also estimated for completion in September, roughly a month after the estimate of the end of the sewer project itself. The delay and increased costs won’t affect resident sewer rates, Clark said.

“Those amounts still leave us close to the $352 million (for the total sewer project) that we talked to the council about last year, and that’s what we’re basing rates on,” Clark said.

Councilwoman Margaret Nyberg originally questioned the need for the project, but says she now feels it is a good idea.

“I talked to a lot of plumbers, and a few people who have been involved on this for a while. and I now understand that in a majority of cases we don’t need them,” Nyberg said, adding that she was told the valves are most useful in cities with storm drains. “We’re not going to have that problem, but if you’ve been down to the wastewater-treatment center and see the things people put in the sewer, you can see why we might need them.”

Nyberg noted that officials have found clothing, diapers and other miscellaneous items dumped in the sewers.

“I think what we need is more education to prevent people from dumping these things, it might not be an issue,” she said. “These valves are not going to be perfect either and letting people know that would be helpful too I think.”

Officials previously said the discovery of the need for the valves was coincidental, as a building-code inspector mentioned the need to Dennis Schilling, a member of the sewer oversight committee, while Schilling was making changes to his private home in 2008. The process in installing the valves was delayed, however, as city budget setbacks led to cuts to the Developmental Services Department in 2009.

Paul F. Miller

Phoenix, Arizona