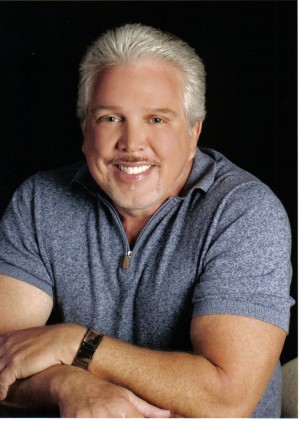

Financial columnist J. Rick Normand asks and answers tough questions about the City of Sedona decision to hire a private debt collection firm rather than train City staff to do the work in his Eye on Sedona column.

Sedona AZ (July 30, 2013) – Is the City of Sedona permanently branding itself as business-unfriendly?

Who is RDS Discovery Systems? They market themselves as Sedona’s Partner! The City of Sedona, as most all of you small business owners in town well know, hired a debt collection agency to which it gave audit authority. In Sedona we know this debt collector as Revenue Discovery Systems or RDS.

But, how many of you, much less non-business-owning residents, know who these people really are? After all, they describe and market themselves as Sedona’s [business] Partners which means that their reputation and publicity accrues to the reputation of our City.

So, let’s start with their name and business structure. You would think that would be a simple matter, wouldn’t you? Not so, but here it is:

Portfolio Recovery Associates Inc. owns Portfolio Recovery Associates, LLC, which is a junk-debt buyer that styles itself as a single-point tax collection administrator who collects on outstanding private, commercial and municipal account balances, and it has a branded Division known as “PRA GOVERNMENT Discovery Systems” which operates under the d/b/a’s of “Anchor Receivables Management, “MuniServices,” and “RDS Discovery Systems” which the City of Sedona hired as a private contractor debt collector.

These companies are headquartered in Norfolk, Virginia, with offices in Birmingham, Alabama.

This convoluted legal structure makes them very difficult to sue by aggrieved parties. The BBB had given Portfolio Recovery Associates LLC an A+ rating as of April 2013 but it has logged 1,303 closed Portfolio Recovery complaints within the previous three years, including 519 closed Portfolio Recovery complaints just within the last 12 months.

RDS Discovery Systems is not BBB Accredited. Another way to track Portfolio Recovery complaints is to look at the number of lawsuits that have been filed against the company. According to Justia.com, Portfolio Recovery was named as a defendant in three dozen lawsuits in March 2013 alone. Meanwhile, I have archived the massive RDS litigation history with the City, including numerous lost Class Action lawsuits.

RDS Discovery Systems is not BBB Accredited. Another way to track Portfolio Recovery complaints is to look at the number of lawsuits that have been filed against the company. According to Justia.com, Portfolio Recovery was named as a defendant in three dozen lawsuits in March 2013 alone. Meanwhile, I have archived the massive RDS litigation history with the City, including numerous lost Class Action lawsuits.

All these associated companies have, collectively, a truly massive and disturbing (losing) litigation history relative to Fair Debt Collection Practices Act (FDCPA) willful violations, consumer fraud and grossly underhanded and illegal predatory collection efforts. Don’t forget…RDS markets itself as a PARTNER with the City of Sedona and their reputation accrues to our City.

In RDS’s monthly notice of “Arizona Transaction Privilege and Use Tax Return” sent out to our small businesses here in Sedona, in the fine print that no one can read without a seriously powerful magnifying glass (that’s not an exaggerated statement), it says “RDS is not responsible for incorrect information and/or improper use of the information provided.”

In RDS’s monthly notice of “Arizona Transaction Privilege and Use Tax Return” sent out to our small businesses here in Sedona, in the fine print that no one can read without a seriously powerful magnifying glass (that’s not an exaggerated statement), it says “RDS is not responsible for incorrect information and/or improper use of the information provided.”

Consider this in light of the fact that just above the fine-print in RDS’s notice of Arizona Transaction Privilege and Use Tax Return it says the following, emboldened in all caps, “A SIGNATURE IS REQUIRED TO MAKE THIS TAX RETURN VALID.”

Are they kidding our whole town? If the small business owner does not sign this so-called monthly Tax Return his/her tax account becomes delinquent even if he/she attaches a check to it for the amount due, but, if he/she does sign in order to validate it, they’ve then signified that they have agreed to waive the right to sue for improper use of taxpayer/citizen information given to this private party…a likely ruthless private collector which has lost God-only knows how many lawsuits and criminal misdemeanor actions for untoward collection/business practices and for unfair distribution of taxpayer private information?

Sedona Arizona population decline and the global meltdown has left a visible impact on the city business community as another sales and bed tax increase is proposed by City Council to offset lost tourist industry revenue

In other words RDS could do serious damage to any of our troubled small business owners by distributing private derogatory information about the small business, or its owner(s), and RDS could assert that our local business owner had “voluntarily” given them a waiver as a defense against the very same Sedona taxpayer’s lawsuit against RDS. They have already used this tactic many times in Court, although several judges have ruled it to be non-enforceable.

Meanwhile, according to Phil Burgess of MicroBilt, a top debt collection industry specialist, the federal government has become especially interested in the identification and eradication of either fraudulent or abusive debt collection agencies in recent years. This industry has a serious problem with a bad reputation. WOW! Is this a way to permanently brand the City of Sedona as “business-unfriendly?”

Regarding its contracts with Arizona cities, there are only four very small towns styled as “PARTNERS” with RDS as follows (no other cities in Arizona would deal with them):

• **Bullhead City, AZ, RDS Partner since tax period March 2009 for the administration of TPT and Use Taxes. According to 2010 Census Bureau estimates, the population of the city is 39,540. The unemployment rate in Bullhead City, AZ, is 9.50%, with job growth of -1.11%. It’s economic base is founded primarily on providing workers and services to Laughlin, NV and the Lake Mead National Recreation Area.

• **City of Sedona, AZ, RDS Partner since tax period January 2011 (contract signed October 2010) for the administration of TPT and Use Taxes. RDS also administers Business Licenses for the City of Sedona.

• City of Somerton, AZ, RDS Partner since tax period January 2011 for the administration of TPT and Use Taxes. Somerton is a city in Yuma County, Arizona, United States. As of the 2010 census the population was 12,014.[1] It is part of the Yuma Metropolitan Statistical Area. Somerton was established in 1898 and incorporated in 1918. Somerton’s economy is based on agriculture and light industry.[3]

• City of Willcox, AZ, RDS Partner starting with tax period March 2011 for the administration of TPT and Use Taxes. Willcox is a city in Cochise County, Arizona, United States. According to 2006 Census Bureau estimates, the population of the city is 3,769. Willcox had the distinction of being a national leader in cattle production. Agriculture remains important to the local economy, but Interstate 10 has replaced the railroad as the major transportation link, and much of the economy is now tied to Interstate 10, which runs immediately north of the town.

**both introduced to RDS by Sedona’s current City Manager Tim Ernster while Sedona’s Council motion to vote for affirmation of a contract with RDS was ram-rodded by current Councilor Barbara Litrell. This means that, sans the influence of Tim Ernster, RDS has only been able to market its services to two tiny agricultural towns in southern Arizona. Yet Sedona prefers to be known as a revered resort town preferred by destination travelers of means. Oh, please!

Characteristics of towns that hire RDS as debt collectors:

Characteristics of towns that hire RDS as debt collectors:

• Unworkable Business Model in a severe recession

• Large transient business population

• High Fee and Tax Rate Schedules

• Consistently declining gross revenues

• Usually an agricultural community or one that primarily services a larger adjacent community (So, why is Sedona is this group?)

Interestingly, when you go to RDS’s website, and then to the “Taxpayer” tab, this is what comes up: Taxpayer; Alabama, Arizona, California, Colorado, Georgia, Kentucky, Louisiana, Oklahoma, Tennessee, and Texas. Most all RDS’ clients are small rural towns in these states.

Let’s continue to look at known highly questionable tactics for collection of taxes that adds to the reputation of RDS, and therefore, to Sedona’s reputation as a highly published Partner of RDS.

Consider this from the NASDAQ stock market (GS: PRAA [beneficial owner of RDS]): “We are aware that the junk debt buying industry is upside down right now because prices have skyrocketed with so many players getting involved in the scavenger debt industry. The fact that PRA (again, the beneficial ultimate owner of RDS) is flooding consumer mailboxes with [Forms]1099-c that are 10-12 years old should be a concern to anyone who is involved in this business.”

Also, regarding all those IRS Forms 1099-c that Portfolio Recovery Management has been sending out on time-barred debts they can’t collect, consider this: According to the West Virginia Attorney General’s Office, “In the case of a debt that has been disputed and cannot be proven, a 1099c is not a valid option for a CA […Collection Attorney] to file. By filing the 1099c they are saying that, ‘yes,’ this is that persons debt and we can prove it is.” However if they cannot validate they cannot file the 1099c…they suggested that “the recipient of the 1099-C file a complaint with our State’s AG office or file a civil suit or both.”

Also, regarding all those IRS Forms 1099-c that Portfolio Recovery Management has been sending out on time-barred debts they can’t collect, consider this: According to the West Virginia Attorney General’s Office, “In the case of a debt that has been disputed and cannot be proven, a 1099c is not a valid option for a CA […Collection Attorney] to file. By filing the 1099c they are saying that, ‘yes,’ this is that persons debt and we can prove it is.” However if they cannot validate they cannot file the 1099c…they suggested that “the recipient of the 1099-C file a complaint with our State’s AG office or file a civil suit or both.”

So, why would the City of Sedona have considered hiring RDS in the first place? The cost of hiring a debt collection agency varies based on the volume of business the City provides and the amount of the debts to be collected. Some collection agencies charge a flat fee up-front to take on a fixed number of accounts. But, most take a percentage of the debts they collect, ranging anywhere from 20% to 50%. The older the account, the higher the percentage will be. This is because older debts are harder to collect and take more of their time to do so.

City of Sedona may want to follow the example of Montana’s revenue director who canceled the state’s tax collection contract after a wave of taxpayer complaints. Montana state employees now collect 4 times the amount of the private collection agency at the same dollar for dollar cost to the state.

Meanwhile, the IRS is retreating from private collectors. The government’s decision follows research done by the IRS taxpayer advocate, Nina E. Olson. She found that two firms, CBE Group in Waterloo, Iowa, and Pioneer Credit Recovery (SLM) in Arcade, N.Y., collected $37 million last year on behalf of the IRS, pocketing $7.5 million in fees and commissions.

Olson calculates that if the IRS had used that same $7.5 million to retrain existing staff, the agency would have collected $250 million. “You really do get much more money for spending $1 on a federal employee than you do paying a $1 commission to a private collection firm,” says Olson.

Unlike private players, federal and municipal employees can impose liens or garnishee wages to recoup unpaid debts. Private debt collectors, in contrast, rely mainly on their powers of persuasive intimidation to get small businesses and consumers to pay up.

Meanwhile, some municipalities have seen inefficiencies as well. Montana’s revenue director, Dan Bucks, decided to cancel the state’s tax collection contract with Houston’s GC Services in 2005 after a wave of taxpayer complaints about the firm. Bucks then plowed funds into the state’s collection efforts. Montana’s revenue department collects $21.08 for every $1 spent on salaries and expenses. GC Services’ record: $5.01 collected for every $1 of cost.

Sedona has the largest number, outright, and largest per capita for this state’s small towns of Staff personnel – and the most highly paid Staff amongst the other three small towns in Arizona who have retained RDS. And, of course, Sedona certainly isn’t an agricultural or secondary service community.

It is implied, then, that our City Staff should certainly be competent to handle its own collections if it thinks the Arizona Department of Revenue hasn’t been enforcing delinquent collections due the City. And, the City has the power to file liens which RDS does not have. Otherwise, since the ghastly reputation of RDS accrues directly to the City of Sedona, why would our town risk further branding ourselves as “business-unfriendly” at the very moment that we need to attract new businesses here to supplement our failing revenue generating policies?

So far, the City of Sedona has offered to the public no comparative analysis of the difference between the net amounts of delinquent sales taxes lost by relying on the Arizona State Department of Revenue and the amounts still not recovered by RDS.

Considering how many small businesses in town that the City Administration has forced out of business, do we need to close out any more opportunities to attract new businesses as well?

Dear Readers:

According to the Public Access to Court Electronic Records (PACER), Portfolio Recovery Associates, parent of Sedona’s self-acclaimed and published PARTNER, Revenue Discovery Systems (“RDS”), has been sued about 1,300 times in the last 3 years. That’s more than one lawsuit a day, every day, for the last three years. In fact, in 2011, Portfolio Recovery Associates was sued 700 times over the harassment practices of its debt collectors. That’s two lawsuits a day, every day, for an entire year! Additionally, the Better Business Bureau processed almost 1,000 billing/collection issues regarding Portfolio Recovery Associates in the last three years. That’s about one complaint every single day for the last three years regarding Portfolio Recovery Associates billing and collection practices. Maybe the little AZ agricultural towns of Willcox and Somerton don’t need to worry about their business reputation, but Sedona, who attracts new businesses due to prospective owners who once visited here, does need to worry about its reputation. What is reported in this article is an absolute deterrent of the promotion of new business development in our town which needs to maintain a persona of charm.

I have done a number of debt collection mediations for McDowell Mountain and the Downtown court in Phoenix that involved Portfolio.

Thanks you for putting out this information in such a researched manner. It definitely should give citizens reason to pause and think about who makes decisions for them.

@Rick.

RDS has a notoriously “shady” reputation per the evidence of complaints and lawsuits you provided. What’s important to understand is that, once contracted, they have a real and tangible incentive to drive otherwise solvent businesses into a state of delinquency, because by doing so, they expand their market and profits. As such, RDS does not work in the City’s best interest. Only its own.

The City, understandably, wants to maximize it revenues. But so does RDS. What’s most telling is that the more RDS succeeds in Sedona, the more the City does not. Not only is wealth systematically extracted from our economy through City mandate vis-a-vis RDS, but also, less revenues end up it City coffers.

For the reasons just stated, City/RDS partnership is a good deal for RDS, and RDS only. Indeed, outsourcing is not a “one size fits all” proposition.

Rick, you’ve done it again! Your research is non-pariel. What an embarrassment to Sedona. It all boils down to a “less than arms length relationship” by our City Engineer – loyalty and blind trust by our Mayor and Council members – a blessing by our City Attorney – and laziness by all, to not bother to look beyond the hype and Power Point presentations, and research who they are signing contracts with on behalf of Sedona, before taking such a serious step. Shame on them all…

I looked on the city’s website and found a whole page about RDS. Why can’t that page show the dollar amount collected? Why can’t a thermometer be put up with the goal at the top and the line with how much of that goal has been collected? Or maybe do a bar graph that goes back 5 years and do the same so we know how effective the collection efforts are and can calculate the rate of return. It’s basic. Who handles the check book at city hall?

on the money

This is a great article, thank you for doing the writing and research the Red Rock News cannot do.

Matt,

That’s an excellent idea, but I have to believe the City doesn’t want the public to know that information.

I am left wondering about the relationship between RDS & (dis)Ernester.

What do the other cities have to say about this, Rick Normand? I don’t see you referencing their experiences. If we agree that the economy is troubled most Sedonans are comfortably settled and the higher cost of living percentages impact us little. We can afford to pay more. A small city that shakes the hands of its residents isn’t doing anything wrong to return favors for the amount of money we pay in tax.

Liked this article on Facebook.

I could never understand why the City of Sedona would hire a private company to collect the city sales tax revenues when the AZ Department of Revenue collected them free of charge. As a business owner and one who files these reports monthly, it is easier to file one form with one address, instead of filing two separate reports with two separate addresses. Why make it more difficult for your local businesses??? For your information all businesses are also being charged a yearly business license fee since RDS’s inception. Another question. why not hire a local company ? Keep the jobs in AZ.

I think back to the days when Sedona was unincorporated. We paid NO city taxes, NO yearly license fees, No sewer fees. Wouldn’t it be great to have a 6.35% sales tax? It was a great place to live and start a business. What happened? Tax and spend seems to be the only topic on the agenda these days at any council meetings. Now we are even being threatened with an additional city property tax.

The City of Sedona is definitely as Rick Normand stated, “business unfriendly”. I might also add to his statement, it’s not very citizen friendly as well. Try speaking at a Sedona City Council Meeting. I feel for those whom have experienced the flooding devastation, the result of poor City Management. But yet our City Council continue to funnel our tax dollars to the Chamber of Commerce.

Allen I hope never to do business with you/ fyi it’s called bribery and graft / It’s wrong.

@ Allen – Your remark, “We can afford to pay more.” reflects total cluelessness on your part. Who is this “We”? You and your rich, spendthrift friends? Get over yourself for a moment and realize there are others in Sedona who are not rich, who cannot “afford to pay more”. After you’ve done that, consider that there are people who in fact “can afford to pay more” but don’t want to waste more.

Allen,

Apparently you didn’t read the article very well. Litigation at the rate of two lawsuits a day and a massive amount of BBB complaints should tell you what other cities think of these debt collectors. Otherwise, I don’t think I need to respond to your comments since other readers at this site made it quite clear what they think of your attitude. I can tell you this…you’re not going to be very popular around town espousing this kind of selfish baloney.

P.S. Allen,

You know, the more I think about it, having spoken at length with the top 6 DORR socialist/marxist activists in town, I know I’ve heard this “We can pay more!” mantra from everyone of them. You speak the same monologue. What they all espouse, including you, is that they take sadistic pleasure in making life tough for the successful entrepreneurs they envy so much, even if it means sacrificing the ability of the poor to survive here who have to pay at the same regressive tax rates as the rich. Yes, it’s clear, you perceive a need to punish the self-made successful in Sedona which excuses your deliberate oversight of the punishment people of your belief system inflict on the poor. That’s sad, truly sad but its the way of the left.

Thank You Rick, for your research and article on RDS. You have quite fully explained exactly why most every business in the City has felt the need to characterizes the City’s revenue raising programs and collection tactics in terms such as, EXTORTION, SHAKEDOWN, TAX THUGS and many more, most always in references to organized crime.

Based on what I’ve read here in your article and the wealth of valuable comments which followed, it is appears as though our City Hall is pretty much in bed with people playing quite a bit outside the lines. Our City’s elected officials and Staff need to be advised of all of this both individually and as a Group, all in a very public way which shall serve the purpose of leaving all plausible denial behind.

Those City Officials that wish to continue to support RDS, will do so knowing that they shall rightfully always wear the accolades or disrepute of that association for all future time.

Those whom are aghast and act immediately and meaningfully on what is brought to their attention, will be conversely known by those actions.

I’ll be interested to know what our City’s elected and Staff Officials decide to do once, they are publicly confronted by the facts of whom they have hired and unleashed like dogs upon Citizens whose interest they receive a paycheck to protect.

Regarding “Allen” Thank you for revealing your existence, however obliquely. It’s been surmised that a very crooked game of pay for play has increasingly been part and parcel with our City Hall….. against all laws to the contrary.

Thank You for validating the seedy existence of the bribery end of that game, Allen.

Jim

For a relationship to last it has to have a positive cost/benefit. When we look at the “City of Sedona”, I see many costs, but virtually no improvement over what existed before we had a city. No Positive benefit except to those who work for or get cash from the “City”.

It is time to end the failed experiment.

I do not want my name published, even here, due to RDS’ predatory practices – hand in hand with the City of Sedona – so if that means you will not publish my comment, so be it.

I have been a small-business owner/operator and home-owner in Sedona for the last 20 years. 90% of my business comes from out-of-state sales, wholesale sales or service-related income; none of this being liable for AZ or Sedona sales tax under current law, so my sales-tax liability is usually just a few dollars per quarter. I have seen our beloved city go from working with residents & business owners to harassing us; lying to us (promises not to take a one-time “business registration fee” into an annual business license or tax) and putting us in the hands of RDS, a predatory collection agency with license by the city to harass and fine even responsible business owners over pennies!

As many others commenting here say, it is time to END THIS OUT-SOURCING CONTRACT. Sedona has NOT benefited from having this RDS contract; the recession is hurting our businesses – mine is currently in the RED overall; thank goodness I saved up during the “fat years” and own my home outright!! Our council should work for its residents’ needs first. We could all do with less grandiose schemes and more day-to-day True Grit to get back to basics. Nuff said.

Title says it best

I have seen our beloved city go from working with residents & business owners to harassing us; lying to us (promises not to take a one-time “business registration fee” into an annual business license or tax) and putting us in the hands of RDS, a predatory collection agency with license by the city to harass and fine even responsible business owners over pennies!

What you’ve written is of concern to everyone in business here. Keep up the good work Rick. Out sourcing should be an anathema to every American for all the best reasons. We have poor that need work, we have poor that need job training opportunities. I’m a proud DORR member that questions whether some of its people are more than boors and demagogues. Not all of us think government makes the perfect mother, father, sister, brother. Balance! Outsourcing beyond ones own area deserves a microscopic view. We have brilliant locals. We have need for jobs. There’s plenty of accountants and accounting firms in town that collect taxes and file the information! Staff has plenty of time to be trained and collect and file taxes without increases in pay. There are plenty of people willing and able to be trained for that job in this town that aren’t city employees. That’s reality.

You all might want to take note that the government released statistics that the newspapers are saying the number of empty homes and foreclosures and short sales inventory in the US is enough to house the entire population of Great Britain. My expletives wont get printed here.