Eye on Sedona Real Estate columnist, Sean Baguely

Sedona AZ (January 25, 2012) – I always like to start with the table below. It shows the Median Prices for closed sales of Residential property only, in the whole of Sedona, quarter by quarter, and gives a fair indication of the levels of activity and of home prices.

I think, taken overall, the Sedona market is pretty stable at this lower level, and I have the sense that things are in fact looking a little better. Other asset classes, e.g. the stock market, are looking up in anticipation of an improvement in the economic situation. This may be due to the acceptance that various stimuli will eventually have an effect, and, with other economies in the world looking vulnerable, inward money flows due to a flight to quality. The two clouds on the 2012 horizon are probably foreclosure activity and mortgage rates.

Units Sold Median Sale Price

| Jan/Mar 2010 |

98 |

$394,950 |

| Apr/Jun 2010 |

117 |

$385,000 |

| Jul/Sep 2010 |

85 |

$387,000 |

| Oct/Dec 2010 |

107 |

$317,000 |

| Jan/Mar 2011 |

90 |

$354,000 |

| Apr/Jun 2011 |

116 |

$303,500 |

| Jul/Sep 2011 |

102 |

$400,000 |

| Oct/Dec 2011 |

79 |

$339,900 |

Fitch, the ratings agency, produced a report at the end of December 2011 which forecasts that “the backlog of real estate owned homes held by banks and the government is staggering. The disposal of these distressed properties in the next two years will depend largely on the strategies taken by Fannie Mae and Freddie Mac.” Fitch went on to add that “Reducing the backlog of foreclosures and speeding up the foreclosure process is crucial to reviving the economy. But the process of unloading REO homes is “hard to predict” and “variable by location.”

Distressed sales currently make up 25% to 35% of total home sales and “more are undoubtedly coming.”

According to Lender Processing Services Inc. “Fannie and Freddie own half of all distressed loans, so disposing of the 2.2 million properties that are currently in foreclosure will depend largely on steps taken by their regulator, the Federal Housing Finance Agency. Another 1.8 million borrowers are 90 days or more delinquent on their mortgages but not yet in foreclosure.”

So, can we expect a tsunami of foreclosures hitting the market, or perhaps more measured sales as the market improves, either individually or through sales to bulk investors, who would rent out the properties?

For closed sales of Residential property only, for 2011 in the whole of Sedona, the statistics for distressed sales show 45 Short Sales and 98 REO Sales. The total is 37% of all closed sales – the split is 31% Short Sales and 69% REOs.

Mortgage rates have been artificially low for some time, and the reasons are not really based on economic fundamentals. The main contributory factors have been government stimuli due to massive job losses, Federal Reserve Quantitative Easing, European sovereign debt fears producing a flight to quality, and low inflation.

As mentioned in the first paragraph, the stock market is starting to assume some level of improvement in the economy, and if the factors above reduce their influence, then mortgage rates will rise and may do rather sharply. It will be interesting to see how this influences the delicate balance between home prices and the ability to obtain financing. For some, the opportunity to acquire a Sedona property with a low mortgage rate may disappear.

The S&P/Case-Shiller Home Price Indices, a trailing indicator, has continued to show signs of stability. The index for the Composite 20 Cities stood at 140.78 for January 2011, and at 140.30 for October 2011. For the Phoenix metropolitan area the levels are 101.54 and 100.54, respectively.

No real changes there.

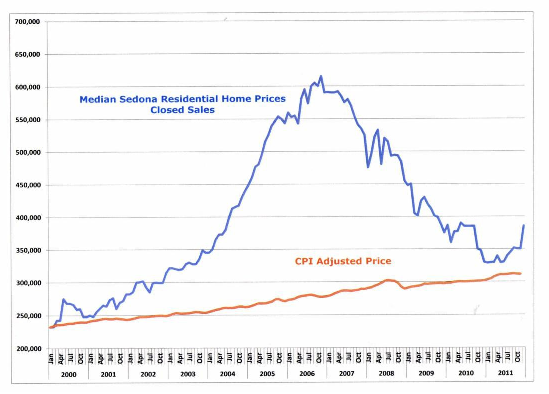

In order to obtain some perspective on prices, I look at the median sold price for six month periods ending with the month in question. This is partly an attempt to reflect the methods of Appraisers, who, when valuing a home, will look at activity over the previous six months, or shorter in a strongly moving market.

The median prices for residential closed sales in all of Sedona have shown an improvement in this series: The six months to the end of January 2011 showed a median price of $328,500 while for the six months to the end of December 2011 a median price of $385,000 was attained, a modest improvement.

Below is a chart of this series plotted against a home first valued at January 2000, and then re-priced monthly by the percentage change in the Consumer Price Index.

Market numbers are courtesy of the Sedona Verde Valley Association of Realtors Multiple Listing Service or as attributed in the text.

You will note the improving trend through 2011.

The Absorption Rate continues to hover around the 10 month line which is taken as the difference between a Buyers’ Market and a Transitional Market: The low was in August 2011 at 8 months and the high was November 2011 at 10.5 months (December 2011 was 10.3 months).

Looking at the various price bands – below $600,000 – the Absorption Rate is 6.6 months; between $600,000 and $1million it is 29.5 months, and, over $1 million it is 52.5 months. This partly reflects the fact that 94% of distressed sales have been at $600,000 or below with 78% being at $400,000 and below. It also underlines that, if you are trying to sell a luxury property, you may have to be patient to achieve your level.

I continue to suspect that the market has formed some sort of base, and if the economy makes some effort to improve after such a long drawn-out recession, then the Sedona property market will improve as well. We still remain one of the most sought after areas to live and visit. A home in Sedona is still on a number of people’s “bucket lists.”

SedonaEye.com real estate columnist, Sean Baguley, is an Associate Broker with Russ Lyon Sotheby’s International Realty, 1370 Hwy 89A, Sedona AZ. Use search words “Sean Baguley” on this site to read all his quarterly Sedona real estate reports.

Sean brings a world of financial and executive skills to the Sedona area real estate table. His earlier career spanned over 30 years in the International Financial Markets, mainly in Bonds and Derivatives, based in London. He has dealt with institutional and corporate clients structuring complex transactions, as well as real estate buyers and sellers investing in retirement homes, moving up, or searching for the perfect desert sanctuary. He is astute about the Sedona property market, having moved here from New York City in October 2001. When buying or selling real estate, it’s essential to work with an agent whose depth of skill spans finance, business, management and marketing.

appreciate the upbeat but realistic views here

lost some basic shops in Flagstaff that’s beginning to change the busy character of downtown

economy not bouncing back in arizona for a looooooooooooooonnnnnnggggggg looooooooooonnnnnnnggggggggg time

renters wanted quick! cheap rents>>> sedona business owners should face the music that sedona glory days over and you better be searching for real customers in a real city that stays active year round