Sedona AZ (January 23, 2013) – The market is finally off the bottom, despite the continuing weak economic recovery. As mortgage rates have remained enticing, Lenders have been able to sell inventory acquired from delinquent borrowers relatively quickly. This fluidity is one of the benefits of being in a non-judicial, or Deed of Trust, State. In Florida, a judicial State, RealtyTrac informs us that the average time taken to foreclose is 858 days. This delay in moving unwanted inventory has only allowed a modest improvement in home values. According to S&P/Case-Shiller, a Miami FL home has increased by 8.5%, whereas a Phoenix AZ home has risen by 21.7%.

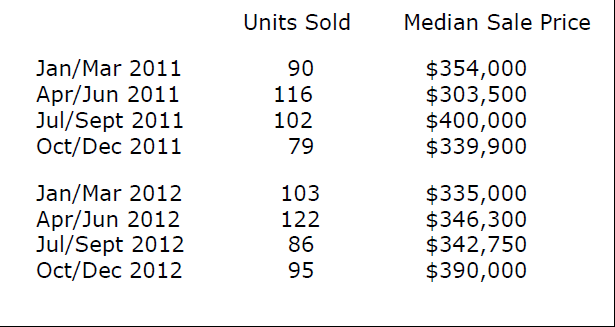

The table above, showing quarterly median Sedona home values, gives an improvement of 14.7%, taking 4th quarter 2011 against 4th quarter 2012. However, before you rush out to castigate your REALTOR®, as they say in some advertising, “Individual results may vary.” There are so many attributes to be considered in valuing a home, especially a home in Sedona. Perhaps the most subjective variant is how to value of the “View.” Placing your home correctly for sale in the marketplace is a skill acquired with experience and knowledge.

I like to take a rolling six month series for sales of Closed Residential Homes (only). I feel this gives a better view of how the market is moving, and it is not unduly influenced by odd or limited data. Looking at this series, the average price per square foot, for the six months ending December 2011, was $173.27 per square foot. The respective number as at December 2012 was $196.14 per square foot, a 12.7% increase.

The chart above shows the six month series for Median prices for closed Residential Home sales with the addition of the first input increased by the monthly percentage change in the Consumer Price Index. This gives a perspective on how property values change over time against the rate of inflation.

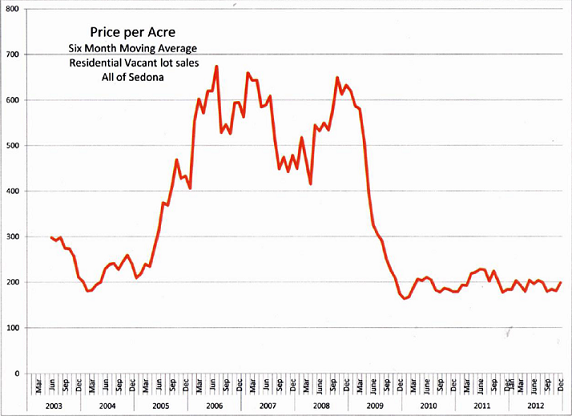

Vacant land sales have been relatively slow to follow the trend. This may in part be due to the reluctance of lenders to help finance unimproved land. In a normal market situation, speculative builders acquire vacant parcels, construct a home, and then sell that home in the secondary market at a profit. The costs associated with that endeavor have not been to the builders’ advantage. Although interest rates are attractive, the costs of supplies (nails; timber; cement; etc.) have increased, as well as the cost of delivery (gas prices). Although the building trade is a lot more optimistic, we have yet to see a major increase in speculative building.

The average number of housing units sold per month in 2012 was 34, which is almost exactly the same as the 33 in 2011. The average number of residential vacant land lots sold per month in 2012 was 10, versus 7 for 2011, which is an improvement, but not a spectacular one.

If you take the total value of the residential acreage sold per month, and divide that by the total acreage, we arrive at a price per acre. The chart below shows this series. Although it doesn’t show the improvement in values that the Residential Homes chart shows, it does look stable.

Please remember that you cannot divide the acre price by, say ¼ to arrive at a value for a quarter acre parcel. The values for vacant land lie along a curve, and smaller parcels will appear to have more value per acre than larger parcels.

The number of foreclosures has reduced over time. At the peak, distressed properties accounted for about 44% of Sedona Residential closed sales. That number is now down to about 24%. Historically, foreclosures (REOs) accounted for about 74% of all distressed sales, while currently they account for about 65%. There were a number of predictions that the Short Sale would come to dominate, but, despite an increased share, that situation has yet to materialize. In 2011, there were 45 closed Residential Short Sale transactions, and 98 REO transactions. The numbers for 2012 are 34 and 63 respectively, only a 4% swing in favor of Short Sales.

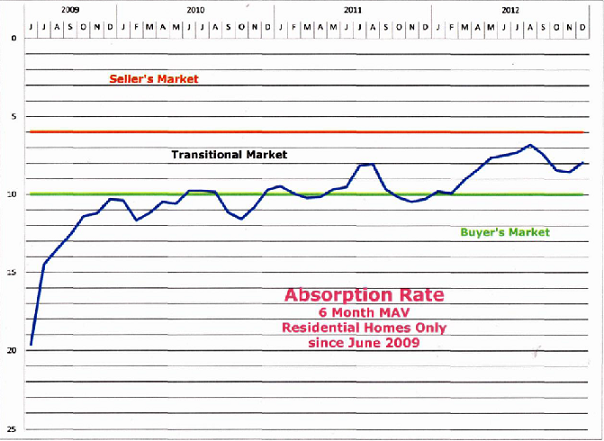

The Absorption Rate has maintained itself in the narrow “Transition” band between a Buyer’s Market and a Seller’s Market. (See chart below).

Splitting the Absorption Rate into groups, below $400,000 the Rate is 3 months; below $600,000 it is 5 months; and below $800,000 it is 6½ months. The Rate for the total market is 7 months. This would seem to indicate that Buyers selected the lower value properties in order to get their piece of Sedona.

There has also been a gradual loss of inventory. The peak number or Residential Homes listed for sale was 290 on July 14th. The number as at December 29th was 246. It will be interesting to see if inventory rebounds in the New Year.

The other slightly contrary fact is the number of price reductions versus price increases. Every week there are a significant number of price reductions, with no real number of price increases. With the market improving, this can only mean that Sellers continue to overprice when first listing their property for sale. Maybe, if things continue to improve, this balance will change. However, there is a “cost” to sitting there waiting. The quantitative things would include utilities; taxes; maintenance etc. while the subjective would be keeping the home spotless, just in case of a showing, and not being able to get on with your new life.

All in all, the Sedona market looks in good shape for 2013 and beyond, assuming the economy and other financial matters improve, as well.

Sean Baguley is an Associate Broker with Russ Lyon Sotheby’s International Realty, 1370 Hwy 89A in Sedona, Arizona. Email Sean at Sean.Baguley@sothebysrealty.com or call him at 928-399-4700 to help with your real estate dreams and lifestyle in beautiful Sedona. Visit Sean’s website which will allow you to search the local MLS. All statistics have been obtained from the Sedona Verde Valley Association of REALTORS® Multiple Listing Service, or as attributed in the text.

Watch For Mortgage Relief Wolves in Government Clothing – Be on the lookout for “mortgage relief” companies that cloak themselves in government logos. The only thing they’ll relieve you of is your cash.

Less than a month after the Consumer Financial Protection Bureau (CFPB) announced it was targeting false mortgage advertising, it shut down two companies that bilked consumers out of $10 million nationwide.

The federal consumer watchdog this week successfully petitioned U.S. District Court Judges in California to shut down the National Legal Help Center, operated by Najia Jalan and Richard K. Nelson and the Gordon Law Firm, operated by Chance Edward Gordon and Abraham Michael Pessar.

CFPB alleges the companies promised to prevent foreclosures or renegotiate troubled mortgages, but violated the Dodd–Frank Wall Street Reform and Consumer Protection Act and Regulation O, formerly known as the Mortgage Assistance Relief Services (MARS) Rule.

The schemes allegedly illegally charged large upfront fees, misrepresented that they would secure loan modifications, instructed homeowners to stop paying their mortgage and reeled in their marks by claiming to be affiliated with government agencies or programs, including the National Mortgage Settlement and the Independent Foreclosure Review.

“We are taking on schemes that prey on consumers who are struggling to pay their mortgages or facing foreclosure,” said CFPB Director Richard Cordray.

Government logos aren’t always government logos

He added, “We are especially concerned with those who misrepresent government programs or websites to divert distressed homeowners from needed assistance.”

The tactics prompted the CFPB to issue the statement, “Just because something has a government logo on it doesn’t mean that it’s legitimate.”

Mortgage assistance and foreclosure relief scams are designed to separate you from your money. They often emblazon their direct mail, email or other information with emblems, logos and names intended to mimic government agencies or programs, lawyers or law firms, or other legitimate operations.

Scammers also frequently reinvent new masquerades to commit fraud. They also frequently target vulnerable struggling homeowners. It’s not always easy to spot them.

Recent fraudulent activity also prompted CFPB to offers red flags that signal when a ruse is likely in the works.

Beware if anyone:

Tells you to stop making mortgage loan payments. Not making your mortgage loan payments could hurt your credit score and limit your options.

Tells you to start making payments to someone other than your servicer or lender.

Asks you to pay high fees upfront to receive services.

Promises to get you a loan modification.

Asks you to sign over title to your property.

Asks you to sign papers you do not understand.

Pressures you to sign papers immediately.

You can learn if the company is bona fide and get help by calling (855) 411-2372 from 8 a.m. to 8 p.m. ET, Monday-Friday to be connected to a U.S. Department of Housing and Urban Development (HUD)-approved housing counselor.

If you think you’ve been scammed, report it immediately. The longer you wait, the more difficult it will be to prevent serious problems.

I sent this to my son in TX & granddaughter in Michigan. Thorough work and analysis/keep it up.

I like his column. Best advice read.

The value of property will keep going down because the prop up is artificial. The banks will let the value rise and then scoop in and get more of the middle class. It will be their artificially inflated market again. I will agree that now is the time to buy. I liked Sedona when we visited but Utah is prettier. Come and visit Zion!

City of Sedona Proposed Ten-Year Capital Improvement Plan – Community Input Period

The City of Sedona is seeking community input on the proposed Ten-Year Capital Improvement Program (CIP). The City will be holding a series of public meetings to provide citizens the opportunity to comment on the proposed Plan and will publish the draft document on the City’s website so citizens may review the proposed projects and project timing, and provide feedback to City staff.

The Capital Improvement Program (CIP) is a comprehensive multi-year plan of proposed capital projects. It represents the City’s plan for physical development, and is intended to identify and balance capital needs within the fiscal capabilities and limitations of the City. The plan is reviewed each year to reflect changing priorities and provides an ongoing framework for identifying capital requirements, scheduling projects over a period of years, coordinating related projects, and identifying future fiscal impacts. Included in the CIP are projects in the areas of drainage, police, parks and recreation, wastewater, information technology, community development, arts, and public works.

“We plan to have public comment opportunities at several regularly scheduled City Commission meetings and to hold a general public meeting on the CIP. This will give the community a variety of days and times to provide input, and at the same time, involve several standing Commissions in the CIP process”, indicated Karen Daines, Assistant City Manager. For those interested community members who might be unable to attend one of the public meetings the proposed Ten-Year CIP is available for review on the City’s website at http://www.SedonaAZ.gov/Finance under the Budget & Audit tab for Fiscal Year 2013-2014.

After the Commission review and public comment period, the City Council is expected to review and approve the CIP in April of 2013. The following public meetings have been scheduled at Sedona City Hall:

· January 31, 2013 – 3:30 p.m. – Planning and Zoning Commission

· February 14, 2013 – 3:30 p.m. – Planning and Zoning Commission

· February 19, 2013 – 5:00 p.m. – General Public Meeting on the CIP

· February 20, 2013 – 10:00 a.m. – Budget Oversight Commission

· February 25, 2013 – 5:00 p.m. – Parks and Recreation Commission

For questions regarding the proposed CIP, please contact Karen Daines at 928-203-5067 or at kdaines@SedonaAZ.gov.

Local Severe Weather Alert for Sedona & Flagstaff, AZ — …WINTER WEATHER ADVISORY IN EFFECT FROM 11 PM THIS EVENING TO 5 PM MST SATURDAY… THE NATIONAL WEATHER SERVICE IN FLAGSTAFF HAS ISSUED A WINTER WEATHER ADVISORY FOR SNOW…WHICH IS IN EFFECT FROM 11 PM THIS EVENING TO 5 PM MST SATURDAY. * TIMING…EXPECT ADVISORY LEVEL SNOW ACCUMULATIONS FROM 11 PM THIS EVENING THROUGH 5 PM MST ON SATURDAY. * MAIN IMPACT…STORM TOTAL SNOW ACCUMULATIONS THROUGH SATURDAY AFTERNOON WILL RANGE FROM 4 TO 7 INCHES ABOVE 6000 FEET…1 TO 4 INCHES BELOW 6000 FEET…THE KAIBAB PLATEAU WILL SEE 6 TO 10 INCHES.

LOCALLY HIGHER AMOUNTS ARE POSSIBLE OVER THE HIGHEST MOUNTAIN PEAKS.

* OTHER IMPACTS…IF YOU ARE TRAVELING INTO NORTHERN ARIZONA FRIDAY NIGHT THROUGH SATURDAY…BE PREPARED FOR DIFFICULT WINTER DRIVING CONDITIONS WITH LIMITED VISIBILITIES DUE TO SNOW ON ICY ROADWAYS.

PRECAUTIONARY/PREPAREDNESS ACTIONS… A WINTER WEATHER ADVISORY FOR SNOW MEANS THAT PERIODS OF FALLING SNOW WILL CAUSE TRAVEL DIFFICULTIES. PLAN EXTRA TIME FOR TRAVEL…AND USE CAUTION WHILE DRIVING. TAKE EMERGENCY TRAVEL SUPPLIES INCLUDING WINTER CLOTHING…FOOD…WATER AND A FLASHLIGHT. FOR THE LATEST ROAD CONDITIONS AND CLOSURES…

don’t think it’s a good time to buy && cant convince me it’s better to buy than rent in az