Sedona AZ (May 8, 2011) – Let us examine the recent flow of negative news. Please remember that the numbers for Sedona refer to Residential homes only and exclude Condominiums and other categories of dwelling.The S&P/Case-Shiller Home Price Indices show home prices in twenty major cities falling by 1% in January, the sixth straight monthly decline. For Phoenix the indices over the last six months have been, August 108.84; September 107.16; October 105.97; November 104.85; December 103.10, and another tumble in January to 101.54.

Over the last year, of the twenty metropolitan areas the indices cover, Phoenix was the worst performing, being down 9.1%. The best performer was Washington D.C. up 3.6%.

David Blitzer, chairman of the S&P index committee was quoted as saying, ‘Sadly, the major contributor to this slow down was due to allegations that the banks and the mortgage service industry were using improper foreclosure processes. This resulted in a postponement of a large number of foreclosures as they instituted a major overhaul of their systems and procedures. To have a decline in prices, as shown by the Indices, as well as a decline in the foreclosure inventory seems contrary.’

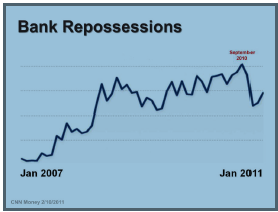

The CNN Money chart above shows the peak for foreclosures in September of 2010 followed by a sudden drop as banks introduced a moratorium in an attempt to get their paperwork straight. After three months, they appear to be back in full gear and proceeding to foreclose all of those properties that they had put on hold.

This has the possibility of leading to a short term increase in the inventory of foreclosed properties for sale.

Analysts at Standard & Poor’s Ratings Services indicated that it may take more than four years to clear the “shadow inventory” of distressed homes in the U.S., a factor that’s likely to undermine real estate prices as the backlog clears. Much of the increase in the estimated months needed to clear shadow inventory is due to the fact that it’s taking longer for lenders to liquidate distressed homes. The current Absorption Rate for distressed Residential homes in Sedona is approximately 4 months, which may indicate a better trend than the US average. Sedona remains an attractive place to live.

According to RealtyTrac Inc, a total of 63,165 U.S. properties received default notices for the first time in February, a 16 percent decrease from the previous month and a 41 percent decrease from February 2010. Default notices reached a 48-month low in February and were 55 percent below the peak of 142,064 in April 2009.

Nevada posted the nation’s highest State foreclosure rate for the 50th straight month in February. One in every 119 Nevada housing units had a foreclosure filing during the month. Arizona posted the nation’s second highest State foreclosure rate, having one in every 178 housing units with a foreclosure filing. California posted the nation’s third highest State foreclosure rate, having one in every 239 housing units with a foreclosure filing.

Over the last year, in Sedona, distressed properties (Short Sales and Foreclosures) accounted for about 42% of Residential home sales.

The caveat for buyers is that the Indices run behind the market. Any improvement in 2011 will not show up in the numbers for at least two months. The Absorption Rate for Sedona residential homes up to $800,000 is currently about 9 ½ months. This defines that area of the market as a Transitional Market, where traditionally a Buyers Market is one with an Absorption Rate above 10 months. As it may take you some time to find the property you want, organize your financing, do your due diligence and close escrow, it is difficult to time the market with a high degree of accuracy. If the market starts to show signs of improvement, Sellers will be much less willing to negotiate.

Competing for properties at the lower end of the price spectrum have been investors. Investors have acquired a fair number of distressed homes, rehabilitated them, and added them to the rental market. This has been of great benefit to those who have lost their homes, as they can continue to live in Sedona by renting rather than owning.

Although the consensus is for rising interest rates, the mortgage market is also looking to return to stability with the introduction of the QRM, or Qualified Residential Mortgage. This is as a result of recent legislation, which attempts to reduce risk in the mortgage market by giving lenders liability for any risky loans that they underwrite. If the lenders stick to the rules for QRMs, they will not have to set aside 5% of the total loan amount in a reserve account to be held against default, and, in some circumstances, they may be given protection from suits from borrowers.

The pattern of real estate activity seems to remain relatively constant in Sedona. The fourth quarter tends to be quieter, with some price slippage, while the first quarter sees an increase in interest and more constant pricing levels. This probably indicates to Sellers that, if they are serious about moving, they should be actively listed on the market during the first six months of the year, and should ask their REALTOR® to help them be realistic with their pricing strategy. This is apparent in the quarterly numbers covering activity in the whole of the Sedona area for closed sales of Residential properties only. Numbers are taken from the Sedona Verde Valley Association of Realtors Multiple Listing Service:

2009/2010/2011 Months – Units Sold — Median Sale Price

Apr/Jun 2009 — 96 — $429,750

Jul/Sep 2009 — 103 — $384,500

Oct/Dec 2010 — 96 — $341,450

Jan/Mar 2010 — 100 — $390,000

Apr/Jun 2010 — 119 — $385,000

Jul/Sep 2010 — 87 — $385,000

Oct/Dec 2010 — 107 — $315,000

Jan/Mar 2011 — 90 — $354,000

Although it is early in the year, I am optimistic that the numbers are showing a return to some sort of stability, especially among the more affordable homes. There is genuine interest from investors and those seeking their piece of Sedona, either for retirement or as a second home. The real estate market runs in long-term cycles and those still waiting to pick the absolute bottom may regret it in five years time if they miss out.

Eye on Sedona Real Estate columnist, Sean Baguely

Learn more about Sean Baguley: Sean has well-honed negotiating skills that make any move simplified and streamlined. His background enables him to see the bigger picture. Clients count on him to weigh their long-term real estate goals and bring dreams into reality. He is astute about the Sedona property market, having moved here from New York City in October 2001. Sean helps buyers and sellers make the most of the area, whether they are investing in a retirement home, moving up, or searching for the perfect desert sanctuary.

When buying or selling a home in Sedona, it’s essential to work with an agent whose depth of skill spans finance, business, management and marketing. Sean Baguley brings all this and a unique compassion for people and their needs to each and every client. As a Sedona Eye and Sedona Times Publishing newspaper columnist, Sean Baguley will be presenting quarterly annual overviews of the Sedona and Sedona area real estate markets.

Follow Sean Baguley and the Sedona Eye online news and views every day. Subscribe now.

News Editor,

Flagstaff market hovers close to negative 8 %. May be worth mentioning.

Will anyone please let me know exactly what the current status is of what at one time was AZ SB 1259 … passed in Senate then it disappeared … was it rolled into some catch-all or is it … dead … ?

AZ SB 1259 Passes in Senate | Foreclosure Industry

Feb 16, 2011 … This a GREAT news for Arizona homeowners. It’s going to get much tougher for the banks to foreclose on your homes. Arizona SB 1259 passed in…

Thank you.

Paul F. Miller

Phone 602-228-2357

U.S. Census Bureau request alarms Tulsa County Assessor written by Phil Boehmke (article shared at the request of reader J.Rick Normand, Sedona AZ):

Buried deep in the bowels of the Patient Protection and Affordable Care Act is a provision to impose a 3.8% tax on real estate transactions. Proceeding without regard to Federal Judge Roger Vinson’s ruling that the health care law is unconstitutional the Obama administration appears to be pushing ahead with implementation of the real estate tax scheme.

The Tulsa World reports that County Assessor Ken Yazel has come under fire for comments made last month during the Tulsa County Republican Convention. Mr. Yazel told the convention that the U.S. Census Bureau had asked his office for information that he believed could be used to help create a data base for collection of a 3.8% real estate sales tax. The steadfast assessor isn’t backing down from his statement.

“I don’t regret saying that,” Yazel said recently. “As far as I’m concerned, this is an intrusion on the Assessor’s Office. But the big question to me is, why are you asking for it?”

Yazel said his office received a letter a few weeks ago from the Census Bureau seeking information about land parcels. The request was something neither he nor his staff had seen before, Yazel said.

“We scratched our heads and began to ask ourselves what this could be about,” Yazel said. “I also inferred that in Obamacare there is a 3.8% tax, and they have to have a baseline to do that.”

Mr. Yazel has wondered about the timing of the request and has expressed concern about the underlying motivation for the data collection.

The letter, dated March 7, 2011, states that the Census Bureau is conducting a study to determine “the feasibility of collecting and producing national statistics on taxable property values.”

It goes on to request eight pieces of information, including the gross assessed value, owner’s name and annual tax bill for all parcels on Tulsa County’s 2009 assessment roles.

The county was selected for the voluntary study as a sample unit for similar-size entities to give the Census Bureau a reliable picture of the entire country, the letter states.

U.S. Census Bureau spokesperson Tom Edwards claims that he was unaware of the letter in question. Edwards did say that the bureau collects data from local government agencies in order to compile national property tax estimates.

In an email, Edwards said “there would be no way to ever attach that figure to any individual.” That sounds a bit suspicious considering that the request asked for “the gross assessed value, owner’s name and annual tax bill.”

According to FactCheck.org ( if they are to be believed) the 3.8% real estate transaction tax would only apply to individuals earning more than $200,000 per year or couples earning $250,000 per year, but Yazel’s concerns are well worth noting. The good citizens of Tulsa County can be thankful that Ken Yazel is on the job and paying attention and that goes for the rest of us too.

FYI ….. THIS IS A RESPONSE RECEIVED RELATIVE TO SB 1259 AND IT DID NOT COME FROM THE LEGISLATURE … WHAT DOES THAT TELL U$ …

Paul – SB1259 became a strike-everything bill for an entirely unrelated subject. I searched for any other bills that created the same statute, but did not find anything that was passed. If I find out anything else, I will pass it along. Thanks. Jeff …

Paul Miller, Phoenix

Mr. Baguley writes a thorough and consise analysis. Bundled with the insightful readers comments, this post I have forwarded to friends and family. I’m not interested in purchasing or selling so don’t want my real name used (do not want to be contacted or called by salesmen or solicitors). Knowing the market is a help with other investments. Thanks from an “Appreciative Reader in Surprise, AZ”.

for sale signs in my west sedona neighborhood still same a year later/some for sale on and off the market in two years

what’s the story about remax and the old wachovia property

From: Michele Reagan [mailto:mreagan@azleg.gov]

Sent: Tuesday, May 03, 2011 2:00 PM

To: Paul Miller (et al)

Subject: RE: SENATE BILL 1259 …

Hi Paul,

Thank you for your interest in SB 1259. Because SB 1259 was my bill, I thought it best if I was the one who responded to you. I ran the bill in the hopes of providing transparency to homeowners. Another troubling aspect about the lack of chain of title information is … what happens if someone sells their house to another person? The keys are handed over, but are you transferring the title as well?? When the lenders packaged and securitized these loans they separated the “notes” and the deeds of trust, violating over a 100 years of property law. The fact that nobody can prove chain of title right now is downright scary. And it is a big elephant in the room that has some property law attorneys dumbfounded. Title insurance may cover some of the future losses, but eventually title insurance will become insolvent. This is a problem that needs to be solved before it causes a future housing meltdown round #2. That being said, this was a very simple bill that would have required a homeowner to be given information. The Senators understood it. It passed 28-2. However, I was told the bill was DOA in the House before it even got out of the Senate. It was “double-assigned” meaning it had to pass two committees instead of just one. In addition, the Chair of the Banking and Insurance committee in the House did not like the bill and was not going to give it a hearing, meaning the bill was dead. By the way, it is completely within the right of any committee chair to kill a bill. Did I like that this happened to my bill – no. But, Rep. McClain did nothing ethically wrong. Committee chairs are completely within their right to hold any bill they do not wish to hear.

In the meantime, there is a section in my district called Rio Verde where they need fire service and a compromise was finally agreed upon that was 6 years in the making. The deadline to introduce new bills had already passed, meaning they had to find a bill to use as a “striker”. SB 1259 was chosen because it was otherwise already dead. The lobbyists representing the Fire Districts and Rural Metro were able to salvage a dead bill and turn it into a bill to give some much needed relief to a part of my district.

Sorry for the lengthy response. But I wanted to give you the whole story from start to finish.

Thanks again for your interest on SB 1259. The good news is that a very similar bill just passed in Arkansas and their Governor has already signed it into law. I will be watching this summer to see what happens once the Arkansas law goes into effect. I hope they are successful and it can be copied in other states. I attached the link below.

http://www.myfoxmemphis.com/dpp/news/arkansas/mcdaniel-details-effect-of-foreclosure-info-bill-apx-20110412

Michele Reagan

Senator Michele Reagan

Chair, Economic Development

District 8

Scottsdale, Fountain Hills and Rio Verde

Thanks to the AZ Senator for the information. Do not agree with the outcome or the “politics” but I do agree with this transparency, and want to ask politicans to stop using this “washing of hands- if you do this then I’ll do that” governance”. It is not values driven democracy. It is expediency, pure and simple. Enjoy your news. Visited Sedona once and liked the pretty hills.

everybody see the big banner across 89a realty building “FORECLOSURE TOUR” — about time that people knew the recession is alive and well in sedona — read in national paper that government is going to stop insuring loans over $600K more or less — goodbye high dollar sedona homes without a LOT of cash in the deals — how will that impact sedona? national papers say we should expect another huge downturn in house values

… View the eleven pictures then tell me if the Real Estate section of the local newspaper is reporting fact or fiction …A Frightening Satellite Tour Of America’s Foreclosure Wastelands • BusinessInsider.com/ ; … http://www.freedomsphoenix.com/News/090497-2011-05-26-a-frightening-satellite-tour-of-americas-foreclosure-wastelands.htm?From=News

Metro Phoenix has a “shadow inventory” of nearly 100,000 homes, the kind that market watchers fear will flood the region’s long-suffering housing market and drive prices down further. Homes in Yavapai County slid another 9.8 percent in value. Pima County, which came in at the 20th largest annual decline, posted an 8.7 percent year-over-year drop with a 4.8 percent decline in values in just the last quarter.

Other Arizona counties measured include Coconino where values slid 7.7 percent from the same time last year, with a 7.5 percent drop in Mohave County.

The slow return of millions of REO homes to the market will keep home prices from recovering. RealtyTrac’s James J. Saccio warns: “At the first quarter foreclosure sales pace, it would take exactly three years to clear the current inventory.

Paul F. Miller

Phoenix, Arizona

Quarterly Sedona Real Estate Update – http://sedonaeye.com …

Posted By Virgil Bierschwale [1] Quarterly Sedona Real Estate Update –

Quarterly Sedona Real Estate Update [2] – sedonaeye.com [3]

Keep America At Work – Founded 5 Nov 2007:

http://keepamericaatwork.com