Sedona AZ (October 15, 2011) – by Sean Baguley, Sedona Eye Real Estate columnist.

I would like to start with what feels to me like some better news.

The table below shows the Median Prices for closed sales of Residential property only, in the whole of Sedona. I like the fact that the third quarter of 2011 shows a higher Median Price level, and that volumes have remained relatively strong. For the upper four quarters of 395 sales, the Median Price is $385,000, and for the lower four quarters of 415 sales, the Median Price is $333,000.

I feel a definite improvement in the market, or, if not, then at least we seem to be pretty stable at this lower level.

| Oct/Dec 2009 |

Units Sold 95 |

Median Sale Price $343,900 |

| Jan/Mar 2010 |

98 |

$394,950 |

| Apr/Jun 2010 |

117 |

$385,000 |

| Jul/Sep 2010 |

85 |

$387,000 |

| Oct/Dec 2010 |

107 |

$317,000 |

| Jan/Mar 2011 |

90 |

$354,000 |

| Apr/Jun 2011 |

116 |

$303,500 |

| Jul/Sep 2011 |

102 |

$400,000 |

The S&P/Case-Shiller Home Price Indices, which is a trailing indicator, has also shown some signs of improvement. Its index for the Composite 20 Cities has improved this year from the March 2011 low of 137.63 to a July 2011 level of 142.77. Sadly the indices for Phoenix show 100.27 and 100.54 respectively, not as good a result, so far.

Foreclosure filings in August 2011 dropped 33 percent as compared with August 2010.

A study by the company RealtyTrac reveals a slowing rate of foreclosures within each of the top ten most foreclosure effected States. However, the press concentrated on the spike in Default Notices in August 2011. This was the biggest single month jump since August 2007, and pushed the numbers to a nine month high. As Default Notices are the first step in the foreclosure process, the press believed that this could foreshadow increased bank repossessions in the months ahead.

The authoritative Cromford Report, which concentrates on the Phoenix area, calmly pointed out that, although this spike may be true outside of Arizona, locally there seemed to be less significance. There was a noticeable rise in foreclosure notices from Recontrust, the company that handles notices for Bank of America, but notices from other trustees remained at the same level as July, and substantially down from 2010.

In the area of mortgages, with Congress failing to take action to extend the FHA and GSE mortgage limits, the maximum loan amounts have been substantially reduced. For the FHA, in Coconino County, the old limit of $450,000 is down to $333,500, a drop of $116,500, and in Yavapai County the old limit of $390,000 is down to $271,050, a reduction of $118,950. Despite continuing low mortgage rates, this is unlikely to be helpful, especially at the lower end of the market.

A key to obtaining a mortgage is an appraisal, and, sadly, Appraisers have come in for further criticism, as deals have fallen through due to lower values. Appraisers continue to do a thorough analytical and thoughtful job, based on diligent research, in order to arrive at their opinions. Their work has become more challenging, owing to the fewer number of sales comparables, lack of information where “special” deals were constructed, and the effect of “ordinary” sales versus distressed “As Is” sales. It may also be fair to say that the general public may not have realized how much home values have dropped since the housing boom. I believe it is important to consult local licensed Loan Officers, and to ask them to request a geographically competent Appraiser, someone who knows Sedona.

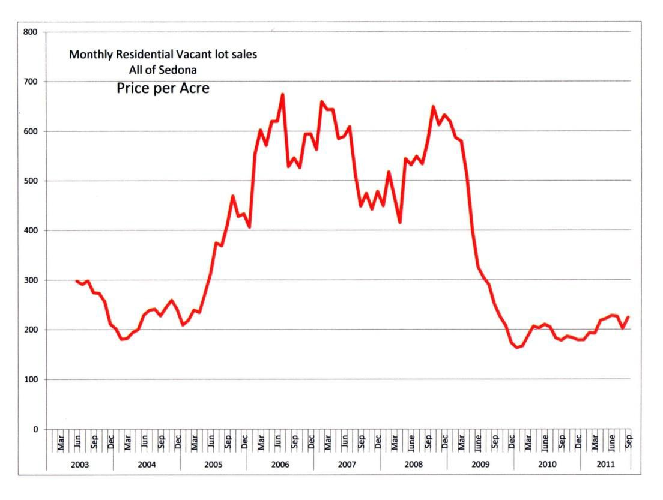

One of the comments I received from my last article was to do with vacant land values.

It is important to understand that prices for vacant residential lots lie along a curve. One cannot simply multiply the price of ¼ acre lot by four to obtain the value of 1 acre parcel, or vice versa. With that thought in mind, here is a chart of Sold Residential Vacant Lots in Sedona only. The series is calculated by taking the total value of sales in each month, and then dividing that by the total acreage of those sales.

Again the market seems to have stabilized in price terms. There are other factors which have an effect on evaluating vacant land, such as the difficulty in obtaining financing. This leads me to discuss the “engine” that drives the property market.

A licensed contractor has the ability to acquire a vacant parcel, construct a home, and put it on the market for sale. There are various costs attached to such an enterprise, as say the cost of the land, the cost of permits and engineering, the cost of materials, labor and financing, to name a few. The contractor, after all these costs, needs to turn a profit in order to feed his family. The contractor has to be able to compete effectively in the market place in order to achieve his goal. The current inventory and pricing structure, exacerbated by the number of distressed properties available to Buyers, is having a negative effect on such activity.

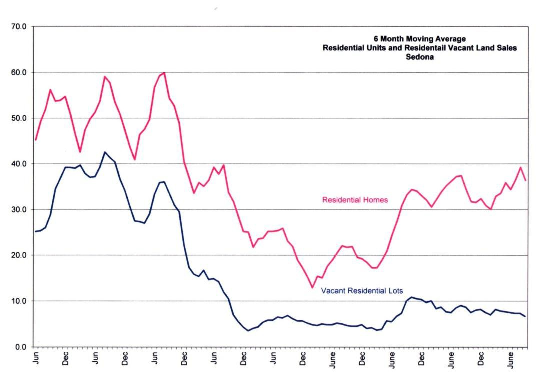

The chart, below, shows two series, smoothed by 6 month moving averages, of the number of Residential Home unit sales, and the number of Residential Vacant Lot unit sales. The chart starts in 2003.

You will note the relatively high correlation between Residential Home sales activity and Residential Vacant Land sales activity between 2003 and 2006.

My feeling is that that relationship has been temporarily broken due to the number of distressed properties for sale, and the “engine” will not return to normal until the economy improves sufficiently to allow us to absorb this inventory.

The Absorption Rate has been tiptoeing along close to the 10 month line, which is taken as the difference between a Buyers’ Market and a Transitional Market, for some time. Taking the last 12 months of activity, the Absorption Rate for Sedona Residential Homes only is 10 months. Below the $250,000price level, an area predominated by foreclosures, the Absorption Rate is only 3 months. In fact, below $600,000 it is close to 7 months only. The Lenders seem to be maintaining an inventory of listings around the 29 level, and are selling about 11 units per month, so the Absorption rate for distressed properties is approximately 2 ½ months.

It appears that the market has reached some sort of equilibrium, and I become less persuaded of a “double-dip” as the volumes and prices remain steady. However, the well-being of the housing market is absolutely dependent on the economy as a whole, and, even with such low interest rates, we need to see a major improvement in the economy to get us moving in the right direction.

All my numbers are courtesy of the Sedona Verde Valley Association of Realtors Multiple Listing Service, or as attributed in the text.

More about Sedona Eye Real Estate columnist Sean Baguley: Sean is an Associate Broker with Russ Lyon Sotheby’s International Realty, 1370 Hwy 89A in Sedona. Contact Sean directly at 928-399-4700 or email sean.baguley@sothebysrealty.com to bring his world of financial and executive skill to the table.

Sean’s earlier career spanned over 30 years in the International Financial Markets, mainly in Bonds and Derivatives, based in London. He has dealt with institutional and corporate clients, structuring complex transactions. His well-honed negotiating skills make any move simplified and streamlined and includes a background that enables him to see the bigger picture. Clients count on him to weigh their long-term real estate goals and bring dreams into reality.

Sean is astute about the Sedona property market, having moved here from New York City in October 2001. He helps buyers and sellers make the most of the area, whether they are investing in a retirement home, moving up, or searching for the perfect desert sanctuary. When buying or selling a home in Sedona, it’s essential to work with an agent whose depth of skill spans finance, business, management and marketing. Sean Baguley brings all this and a unique compassion for people and their needs to each and every client.

Follow Sean’s exclusive Sedona Times Publishing newspaper real estate reports and reviews, subscribe now to SedonaEye.com.

We had a real eye opener after talking to our agent in Prescott. Our house was worth half of what we thought. We’re still in shock.

The Arizona Association of REALTORS® (AAR) installed its 2012 officers at its Leadership Conference this week in Phoenix. Holly Mabery will be president next year. She is the current president-elect and served as first vice-president in 2010 and treasurer in 2009.

Mabery is an associate broker and trainer for Keller Williams Check Realty in Prescott, Sedona and Flagstaff. Mabery was twice honored as REALTOR® of the year in 2004 and 2007 by the Sedona/Verde Valley Association of REALTORS®. She is a third-generation REALTOR® and native Arizonan.

“It’s an honor to serve as the 2012 AAR president and represent the outstanding professionals in our industry,” said Mabery. “This is an excellent organization that provides a valuable resource for our members.”

In addition to her AAR duties, Mabery is the National Association of REALTORS® liaison to Arizona 1st District Congressional Representative Paul Gosar and former Rep. Ann Kirkpatrick.

Other officers for 2012 include President-Elect John J. “Jack” Woerner of Coldwell Banker Residential Realty in Green Valley. Sue Flucke will be First Vice President. She is with Keller Williams Realty Professional Partners in Surprise. Evan Fuchs will serve as Treasurer. He is with Bullhead Laughlin Realty in Bullhead City.

The new 2012 officers take office on December 1, 2011.

The Arizona Association of REALTORS® is the largest professional trade association in the state. It’s comprised of individuals involved in the real estate industry, allied industries and firms. The association’s more than 38,000 members represent more than half of the real estate licensees in Arizona. For more information about the Arizona Association of REALTORS®, visit the organizations website at http://www.aaronline.com.

good article sean, important info

An Italian, a Greek and a Spaniard are having a drink in a bar.

Who pays?

The German